CW+ Premium Content/E-Handbooks

-

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

2025 Technology Priorities in APAC

Download

-

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

Top tech stories of 2024: ASEAN (Part 1)

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Collaboration vital for making DEI progress

Download

-

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

CrowdStrike outage explained: What happened and what can we learn?

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download

-

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download -

E-Handbook

Collaboration vital for making DEI progress

Download

-

E-Handbook

Top tech stories of 2024: India (Part 1)

Download -

E-Handbook

A Computer Weekly buyer’s guide to IT energy reduction

Download -

E-Handbook

Beginner's guide to Internet of Things

Download -

E-Handbook

19 machine learning interview questions and answers

Download

-

E-Handbook

Top 10 ASEAN IT stories of 2022

Download -

E-Handbook

Real-time analytics extends the reach of its business value more and more

Download -

E-Handbook

Predictive analytics gains evermore accuracy in guiding enterprises forward

Download -

E-Handbook

Royal Holloway: Deep learning for countering energy theft

Download

-

E-Handbook

Infographic: Five stages of supply chain management

Download -

E-Handbook

10 metaverse use cases for IT and business leaders

Download -

E-Handbook

Executive Interview: Unleashing blockchain's potential

Download -

E-Handbook

CW Innovation Awards: Singapore Airlines' blockchain app unlocks loyalty rewards

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

CrowdStrike outage explained: What happened and what can we learn?

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

How do cybercriminals steal credit card information?

Download

-

E-Handbook

Top tech stories of 2024: India (Part 1)

Download -

E-Handbook

A Computer Weekly buyer’s guide to SaaS integration

Download -

E-Handbook

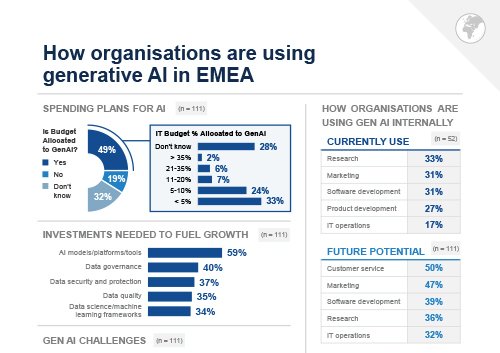

Infographic: How organisations are using generative AI in EMEA

Download -

E-Handbook

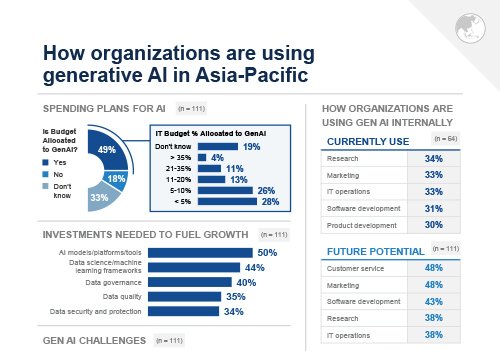

Infographic: How organizations are using generative AI in Asia-Pacific

Download

-

E-Handbook

A Computer Weekly buyer’s guide to IT energy reduction

Download -

E-Handbook

Beginner's guide to Internet of Things

Download -

E-Handbook

Predictive analytics gains evermore accuracy in guiding enterprises forward

Download -

E-Handbook

Business analytics needs underpinnings of sound data and data-skilled humans

Download

-

E-Handbook

A Computer Weekly buyer’s guide to auditing and testing data models

Download -

E-Handbook

A Computer Weekly buyer’s guide to AI, ML and RPA

Download -

E-Handbook

Royal Holloway: Deep learning for countering energy theft

Download -

E-Handbook

Robotic Process Automation blends into AI for thoroughly modern ERP

Download

-

E-Handbook

A Computer Weekly buyer’s guide to post-Covid supply chain management

Download -

E-Handbook

A Computer Weekly buyer’s guide to SIEM and SOAR

Download -

E-Handbook

CW Innovation Awards: Flybuys cranks up cloud for service efficiency

Download -

E-Handbook

CW Innovation Awards: Inside Bharat Petroleum's digital nerve centre

Download

-

E-Handbook

Computer Weekly 2024 salary survey

Download -

E-Handbook

The importance of getting everyone involved in the diversity drive

Download -

E-Handbook

Ultimate guide to digital transformation for enterprise leaders

Download -

E-Handbook

A Computer Weekly buyer’s guide to SaaS integration

Download

-

E-Handbook

A Computer Weekly buyer’s guide to developer experience

Download -

E-Handbook

A Computer Weekly buyer’s guide to auditing and testing data models

Download -

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

A Computer Weekly buyer’s guide to secure coding

Download

-

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

10 metaverse use cases for IT and business leaders

Download -

E-Handbook

Royal Holloway: Security evaluation of network traffic mirroring in public cloud

Download

-

E-Handbook

The growth of cloud-based networking: What to expect in 2022 and beyond

Download -

E-Handbook

A Computer Weekly buyer’s guide to training programmes and tools

Download -

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download -

E-Handbook

IT Priorities 2022: What IT decision-makers are planning

Download

-

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

A Computer Weekly buyer’s guide to secure coding

Download -

E-Handbook

The ultimate guide to identity & access management

Download -

E-Handbook

How do cybercriminals steal credit card information?

Download

-

E-Handbook

Top 10 ANZ IT stories of 2022

Download -

E-Handbook

Top 10 India IT stories of 2022

Download -

E-Handbook

A Computer Weekly buyer’s guide to anti-ransomware

Download -

E-Handbook

Guide to building an enterprise API strategy

Download

-

E-Handbook

A Computer Weekly buyer’s guide to training programmes and tools

Download -

E-Handbook

Hybrid cloud connectivity best practices

Download -

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download -

E-Handbook

Managing hybrid cloud deployments: What enterprises need to know

Download

-

E-Handbook

Top 10 cloud stories of 2021

Download -

E-Handbook

What the future holds for cloud management in APAC

Download -

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download -

E-Handbook

Cloud Market Report Australia

Download

-

E-Handbook

The role of microservices in agile enterprises

Download -

E-Handbook

Datacentre design: Building leaner, greener server farms

Download -

E-Handbook

How open source is spurring digital transformation

Download -

E-Handbook

Converged infrastructure in 2021: Next-generation datacentre designs

Download

-

E-Handbook

Top 10 ASEAN IT stories of 2020

Download -

E-Handbook

Top 10 datacentre stories of 2019

Download -

E-Handbook

Infographic: 6 steps to containerised storage success

Download -

E-Handbook

Nordics are leading the datacentre revolution

Download

-

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download -

E-Handbook

Digital Experience platforms intensify customer engagement programmes

Download -

E-Handbook

Infographic: 5 differences between call centers and contact centers

Download

-

E-Handbook

Customer service technologies emerge bloodied but unbowed from Covid-19 pandemic

Download -

E-Handbook

A Computer Weekly buyer’s guide to digital customer experience

Download -

E-Handbook

Marketing software moves closer to centre of the CIO's vision

Download -

E-Handbook

Real-time analytics possible fuel for post Covid pandemic growth

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

The ultimate guide to identity & access management

Download -

E-Handbook

How do cybercriminals steal credit card information?

Download

-

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

The development of wired and wireless LANs in a hybrid work model

Download -

E-Handbook

How to achieve network infrastructure modernization

Download -

E-Handbook

A Computer Weekly buyer’s guide to communications as a service

Download

-

E-Handbook

Top 10 networking stories of 2021

Download -

E-Handbook

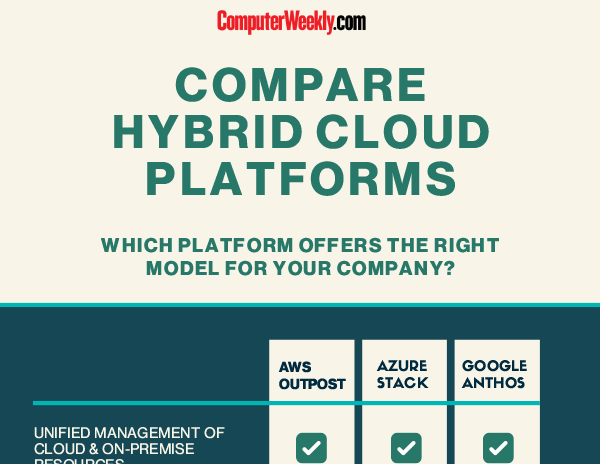

Infographic: Compare hybrid cloud platforms

Download -

E-Handbook

The rise of edge computing

Download -

E-Handbook

Ofcom raise over £1.3bn in new 5G spectrum auction

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

IT Priorities 2022: What IT decision-makers are planning

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download -

E-Handbook

Infographic: 5 ways backup can protect against ransomware

Download

-

E-Handbook

AWS vs Azure vs Google: 5 key benefits each for cloud file storage

Download -

E-Handbook

Container technologies and trends: What enterprises need to know

Download -

E-Handbook

Kubernetes: What enterprises need to know

Download -

E-Handbook

IT Priorities 2020: Covid-19 consolidates storage push to cloud

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Infographic: 5 considerations before buying data center backup software

Download -

E-Handbook

Data backup failure: Top 5 causes and tips for prevention Infographic

Download -

E-Handbook

Step-by-step disaster recovery planning guide

Download

-

E-Handbook

IT Priorities 2022: What IT decision-makers are planning

Download -

E-Handbook

The vulnerability of backup in a predominantly remote + cloud world

Download -

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download

-

E-Handbook

Top IT predictions in APAC in 2025

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

Fail to prepare quality data, prepare to fail

Download -

E-Handbook

10 steps to building a data catalog

Download

-

E-Handbook

Top 10 India IT stories of 2022

Download -

E-Handbook

10 steps to building a data catalog

Download -

E-Handbook

Predictive analytics gains evermore accuracy in guiding enterprises forward

Download -

E-Handbook

Business analytics needs underpinnings of sound data and data-skilled humans

Download

-

E-Handbook

Automated document management system tools transform workflows

Download -

E-Handbook

Real-time analytics expands its business value compass

Download -

E-Handbook

CW Innovation Awards: Flybuys cranks up cloud for service efficiency

Download -

E-Handbook

Executive Interview: Tapping APAC's storage potential

Download

-

E-Handbook

A Computer Weekly buyer’s guide to AI, ML and RPA

Download -

E-Handbook

Digital Experience platforms intensify customer engagement programmes

Download -

E-Handbook

Infographic: 5 differences between call centers and contact centers

Download -

E-Handbook

Executive Interview: Juergen Mueller on SAP's tech strategy

Download

-

E-Handbook

A guide to where mainframes fit in the cloud

Download -

E-Handbook

Top 10 datacentre stories of 2021

Download -

E-Handbook

A hybrid approach: How the conversation around cloud is changing

Download -

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download

-

E-Handbook

Datacentre design: Building leaner, greener server farms

Download -

E-Handbook

Infographic: Compare hybrid cloud platforms

Download -

E-Handbook

Converged infrastructure in 2021: Next-generation datacentre designs

Download -

E-Handbook

A Computer Weekly buyer’s guide to datacentre cooling

Download

-

E-Handbook

A Computer Weekly buyer’s guide to auditing and testing data models

Download -

E-Handbook

A Computer Weekly buyer’s guide to IT energy reduction

Download -

E-Handbook

A Computer Weekly buyer’s guide to data visualisation

Download -

E-Handbook

A Computer Weekly buyer’s guide to the circular economy

Download

-

E-Handbook

A Computer Weekly buyer’s guide to auditing and testing data models

Download -

E-Handbook

A Computer Weekly buyer’s guide to IT energy reduction

Download -

E-Handbook

A Computer Weekly buyer’s guide to data visualisation

Download -

E-Handbook

A guide to where mainframes fit in the cloud

Download

-

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Implementing GenAI: Use cases & challenges

Download -

E-Handbook

Data governance for all seasons and reasons

Download -

E-Handbook

How open source is spurring digital transformation

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Infographic: 5 considerations before buying data center backup software

Download -

E-Handbook

Data backup failure: Top 5 causes and tips for prevention Infographic

Download -

E-Handbook

Step-by-step disaster recovery planning guide

Download

-

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download -

E-Handbook

Understanding Kubernetes to build a cloud-native enterprise

Download -

E-Handbook

A Computer Weekly buyer’s guide to containerisation in the enterprise

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Collaboration vital for making DEI progress

Download

-

E-Handbook

Computer Weekly 2024 salary survey

Download -

E-Handbook

The importance of getting everyone involved in the diversity drive

Download -

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

E-Handbook

Infographic: How organizations are using generative AI in Asia-Pacific

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Collaboration vital for making DEI progress

Download

-

E-Handbook

Computer Weekly 2024 salary survey

Download -

E-Handbook

The importance of getting everyone involved in the diversity drive

Download -

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

E-Handbook

Infographic: How organizations are using generative AI in Asia-Pacific

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

CrowdStrike outage explained: What happened and what can we learn?

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download

-

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

10 common uses for machine learning applications in business

Download -

E-Handbook

Guide to building an enterprise API strategy

Download -

E-Handbook

Executive Interview: Unleashing blockchain's potential

Download

-

E-Handbook

CW Innovation Awards: How DBS is transforming credit processes

Download -

E-Handbook

CW Innovation Awards: DBS Bank Project of the Year Interview [Video]

Download -

E-Handbook

Getting the best out of robotic process automation

Download -

E-Handbook

A Computer Weekly buyer’s guide to next-generation retail technology

Download

-

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

Guide to building an enterprise API strategy

Download -

E-Handbook

The Ultimate Guide to Enterprise Content Management

Download -

E-Handbook

Infographic: 5 differences between call centers and contact centers

Download

-

E-Handbook

CW Innovation Awards: Sime Darby ups ante on service management

Download -

E-Handbook

CRM enters maturity as customer experience custodian

Download -

E-Handbook

A Computer Weekly buyer's guide to automating business processes

Download -

E-Handbook

Digital experience focus broadens to encompass employees

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download

-

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download

-

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download -

E-Handbook

AWS vs Azure vs Google: 5 key benefits each for cloud file storage

Download -

E-Handbook

Container technologies and trends: What enterprises need to know

Download

-

E-Handbook

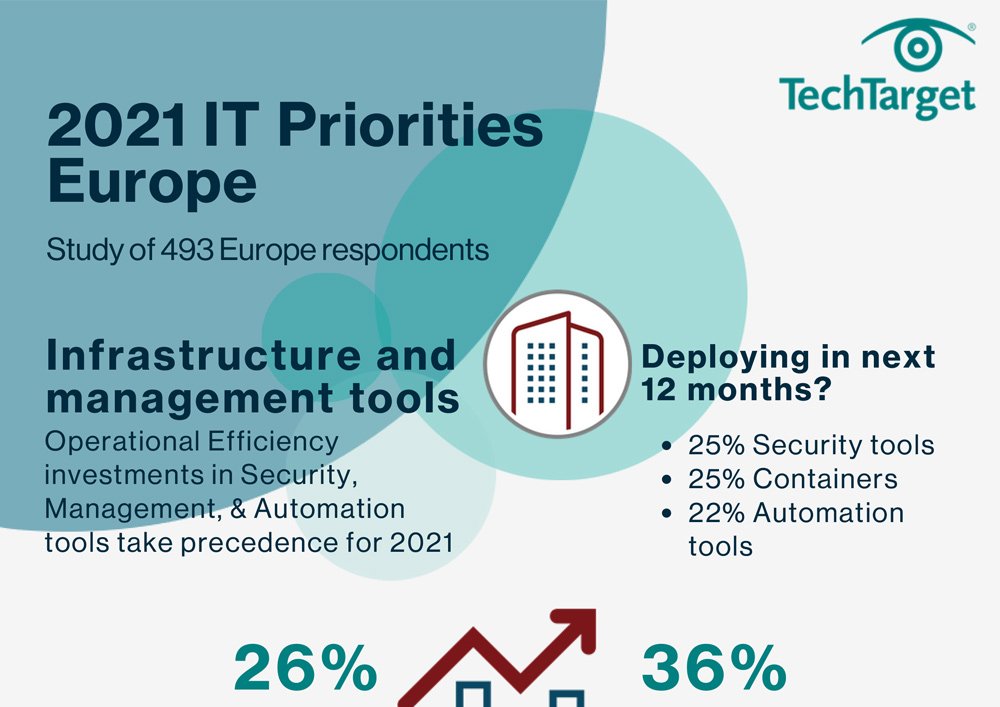

IT Priorities 2021 - European Topics Infographic

Download -

E-Handbook

Kubernetes: What enterprises need to know

Download -

E-Handbook

IT Priorities 2020: Covid-19 consolidates storage push to cloud

Download -

E-Handbook

Eyes on India: New age of flash storage boosts performance & efficiency

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download

-

E-Handbook

A Computer Weekly buyer’s guide to SaaS integration

Download -

E-Handbook

A Computer Weekly buyer’s guide to green tech for business

Download -

E-Handbook

A Computer Weekly buyer’s guide to data visualisation

Download -

E-Handbook

A Computer Weekly buyer’s guide to financial analytics for planning

Download

-

E-Handbook

A Computer Weekly buyer’s guide to AI, ML and RPA

Download -

E-Handbook

A Computer Weekly buyer’s guide to customer and employee experience management

Download -

E-Handbook

A Computer Weekly buyer’s guide to training programmes and tools

Download -

E-Handbook

Ethics at the heart of emerging AI strategies

Download

-

E-Handbook

Royal Holloway: Secure multiparty computation and its application to digital asset custody

Download -

E-Handbook

CW Innovation Awards: How DBS is transforming credit processes

Download -

E-Handbook

CW Innovation Awards: DBS Bank Project of the Year Interview [Video]

Download -

E-Handbook

2021 UKI Salary Survey Analysis Video

Download

-

E-Handbook

IR35 reforms: Confusion over who pays employers' NI leaves IT contractors out of pocket

Download -

E-Handbook

Royal Holloway: Protecting investors from cyber threats

Download -

E-Handbook

Financial applications automation – promise is real but needs business nous

Download -

E-Handbook

IT Priorities 2020: Budgets rejigged to support 2021 recovery

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

A Computer Weekly buyer’s guide to green tech for business

Download -

E-Handbook

10 steps to building a data catalog

Download -

E-Handbook

Data governance for all seasons and reasons

Download

-

E-Handbook

A Computer Weekly buyer’s guide to API management

Download -

E-Handbook

Royal Holloway: Information security of the 2016 Philippine automated elections

Download -

E-Handbook

India IT Priorities 2022: Top Observations & Trends

Download -

E-Handbook

ASEAN IT Priorities 2022: Top Observations & Trends

Download

-

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

Computer Weekly 2024 salary survey

Download -

E-Handbook

The importance of getting everyone involved in the diversity drive

Download

-

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

Computer Weekly/TechTarget 2023 salary survey infographic

Download -

E-Handbook

Inclusion = everyone: Expert advice for improving tech diversity

Download -

E-Handbook

19 machine learning interview questions and answers

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

A Computer Weekly buyer’s guide to green tech for business

Download

-

E-Handbook

10 steps to building a data catalog

Download -

E-Handbook

Data governance for all seasons and reasons

Download -

E-Handbook

A Computer Weekly buyer’s guide to financial analytics for planning

Download -

E-Handbook

A Computer Weekly buyer’s guide to customer and employee experience management

Download

-

E-Handbook

2022 Media Consumption Study: Fact or fiction - The rep-free buying experience

Download -

E-Handbook

2022 Media Consumption Study: Push the right content to the right channel

Download -

E-Handbook

2022 UKI Media Consumption Study: Is digital fatigue overblown?

Download -

E-Handbook

2022 UKI Media Consumption Study: Transform your face-to-face event thinking

Download

-

E-Handbook

A Computer Weekly buyer’s guide to the circular economy

Download -

E-Handbook

The growth of cloud-based networking: What to expect in 2022 and beyond

Download -

E-Handbook

2021 UKI Media Consumption Infographic: Digital research preferences

Download -

E-Handbook

2021 UKI Media Consumption Infographic: Impact of the Pandemic on IT Purchasing

Download

-

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

Computer Weekly 2024 salary survey

Download

-

E-Handbook

The importance of getting everyone involved in the diversity drive

Download -

E-Handbook

Computer Weekly/TechTarget 2023 salary survey infographic

Download -

E-Handbook

A Computer Weekly buyer’s guide to post-Covid supply chain management

Download -

E-Handbook

Stronger collaboration platforms emerge as pandemic legacy

Download

-

E-Handbook

Implementing GenAI: Use cases & challenges

Download -

E-Handbook

A Computer Weekly buyer’s guide to green tech for business

Download -

E-Handbook

A guide to what to look for in Application Performance Monitoring and Observability

Download -

E-Handbook

2022 Media Consumption Study: Fact or fiction - The rep-free buying experience

Download

-

E-Handbook

2022 Media Consumption Study: Push the right content to the right channel

Download -

E-Handbook

2022 UKI Media Consumption Study: Is digital fatigue overblown?

Download -

E-Handbook

2022 UKI Media Consumption Study: Transform your face-to-face event thinking

Download -

E-Handbook

2022 UKI Media Consumption Study: Characteristics of the Buying Team

Download

-

E-Handbook

The CISO's guide to supply chain security

Download -

E-Handbook

Cloud Market Report Australia

Download -

E-Handbook

Public cloud in India: A guide to building digital resiliency

Download -

E-Handbook

Under new cloud management: What the future holds for AWS

Download

-

E-Handbook

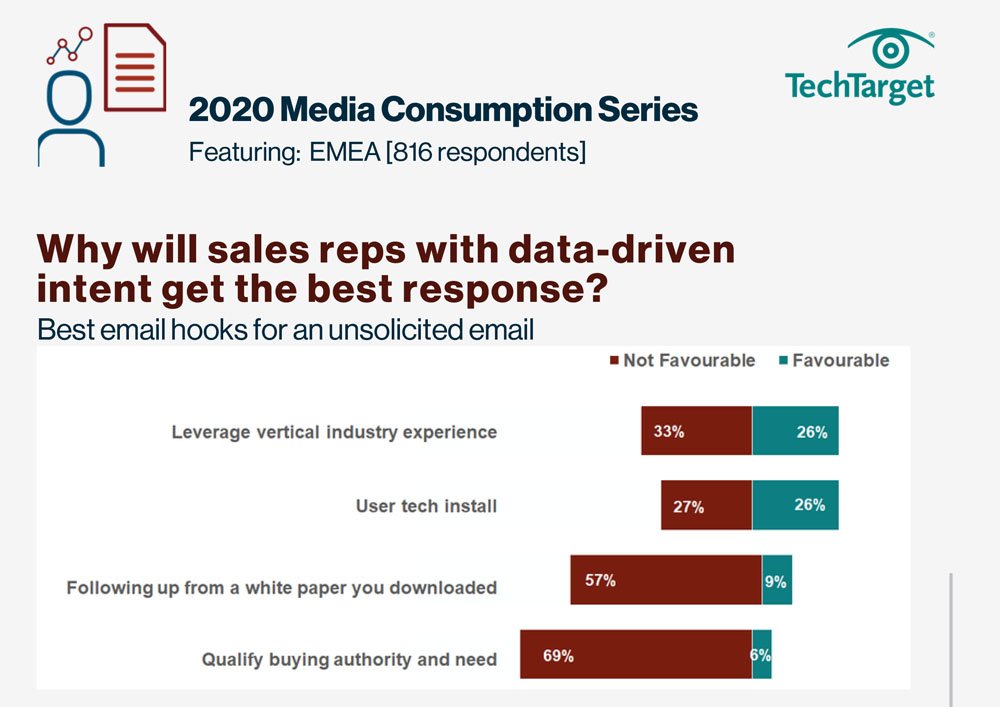

2020 Media Consumption Series - Why

Download -

E-Handbook

2020 Media Consumption Series - Where

Download -

E-Handbook

Project Brief: Inside Juniper's radical IT transformation

Download -

E-Handbook

Inside India: The world’s IT powerhouse

Download

-

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

Top tech stories of 2024: ASEAN (Part 1)

Download

-

E-Handbook

Implementing GenAI: Use cases & challenges

Download -

E-Handbook

A Computer Weekly buyer’s guide to green tech for business

Download -

E-Handbook

A Computer Weekly buyer’s guide to financial analytics for planning

Download -

E-Handbook

The enterprise guide to video conferencing in 2023

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

Implementing GenAI: Use cases & challenges

Download

-

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

E-Handbook

Infographic: How organizations are using generative AI in Asia-Pacific

Download -

E-Handbook

A Computer Weekly buyer’s guide to secure coding

Download

-

E-Handbook

Risk management is the beating heart of your cyber strategy

Download -

E-Handbook

Step-by-step disaster recovery planning guide

Download -

E-Handbook

Shields up! Why Russia’s war on Ukraine should matter to security pros

Download -

E-Handbook

Ransomware: The situation at the beginning of 2022 Infographic

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download

-

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

Collaboration vital for making DEI progress

Download -

E-Handbook

Computer Weekly 2024 salary survey

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download

-

E-Handbook

Computer Weekly/TechTarget 2023 salary survey infographic

Download -

E-Handbook

A Computer Weekly buyer’s guide to automation and autonomous control

Download -

E-Handbook

19 machine learning interview questions and answers

Download -

E-Handbook

APAC career guide: Becoming a cyber security pro

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

CrowdStrike outage explained: What happened and what can we learn?

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download

-

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Top tech stories of 2024: ASEAN (Part 1)

Download -

E-Handbook

Infographic: How organizations are using generative AI in Asia-Pacific

Download -

E-Handbook

Top 10 ASEAN IT stories of 2022

Download

-

E-Handbook

Royal Holloway: Information security of the 2016 Philippine automated elections

Download -

E-Handbook

The CISO's guide to supply chain security

Download -

E-Handbook

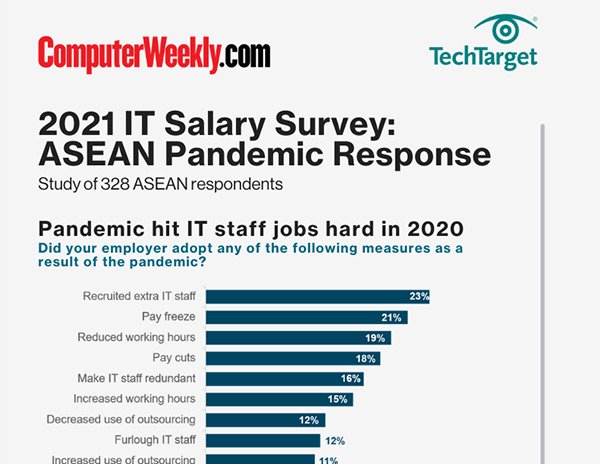

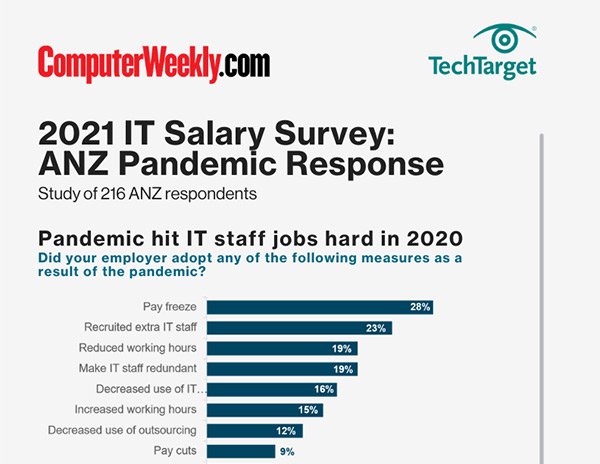

2021 ASEAN Salary Survey - Pandemic Response Infographic

Download -

E-Handbook

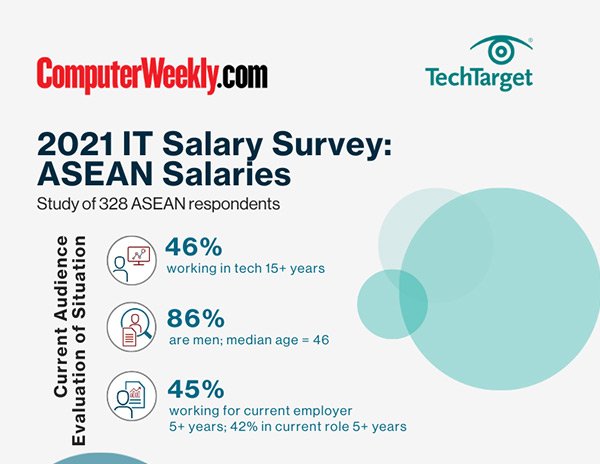

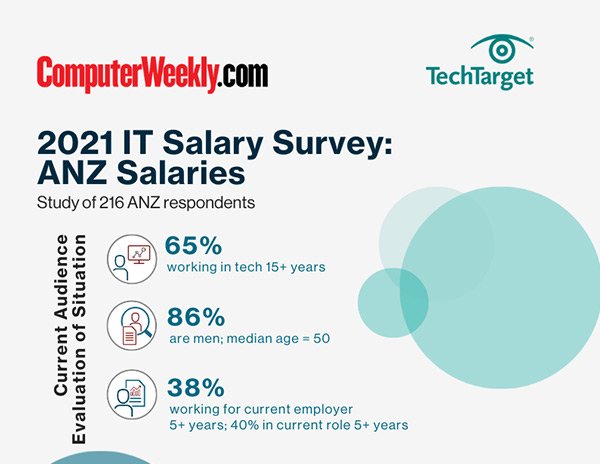

2021 ASEAN Salary Survey - Salary Infographic

Download

-

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

Beginner's guide to Internet of Things

Download

-

E-Handbook

What the future holds for cloud management in APAC

Download -

E-Handbook

IT Priorities 2022: APAC enterprises invest in digital future

Download -

E-Handbook

CW Innovation Awards: Bharti Airtel taps OpenStack to modernise telco network

Download -

E-Handbook

CW Innovation Awards: NUHS taps RPA in Covid-19 swab tests

Download

-

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

Infographic

Infographic: 2022 IT Salary Survey - Benelux Salaries

Download -

E-Handbook

Top 10 Benelux stories of 2021

Download -

E-Handbook

2021 UKI Salary Survey Results

Download

-

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

Infographic

Infographic: 2022 IT Salary Survey - Middle East Salaries

Download -

E-Handbook

2022 Middle East IT Priorities Infographic: Budgets and Buying Patterns

Download -

E-Handbook

Middle East - 2022 IT Priorities Survey Results

Download

-

E-Handbook

Top 10 Middle East IT stories of 2021

Download -

E-Handbook

Saudi IT spending to hit $11bn in 2021

Download -

E-Handbook

2021 UKI Salary Survey Results

Download -

E-Handbook

CIO Trends #11: Middle East

Download

-

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

Infographic

Infographic: 2022 IT Salary Survey - Nordics Salaries

Download -

E-Handbook

Top 10 Nordic IT stories of 2021

Download -

E-Handbook

2021 UKI Salary Survey Results

Download

-

E-Handbook

IT Priorities 2020: European IT budget share reflects home-working challenges brought by Covid

Download -

E-Handbook

IT Priorities 2020: Budgets rejigged to support 2021 recovery

Download -

E-Handbook

CIO Trends #11: Nordics

Download -

E-Handbook

Nordics' IT leaders facing the coronavirus crisis

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

Beginner's guide to Internet of Things

Download -

E-Handbook

10 metaverse use cases for IT and business leaders

Download

-

E-Handbook

Ultimate IoT implementation guide for businesses

Download -

E-Handbook

Royal Holloway: Securing connected and autonomous vehicles

Download -

E-Handbook

A Computer Weekly buyer’s guide to communications as a service

Download -

E-Handbook

Headline: Royal Holloway: Attack mapping for the internet of things

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

2025 Technology Priorities in APAC

Download -

E-Handbook

Top IT predictions in APAC in 2025

Download

-

E-Handbook

A Computer Weekly buyer’s guide to automation and autonomous control

Download -

E-Handbook

A guide to developing modern mobile applications

Download -

E-Handbook

A Computer Weekly buyer’s guide to 5G mobile networking

Download -

E-Handbook

A Computer Weekly buyer’s guide to secure and agile app development

Download

-

E-Handbook

A Computer Weekly buyer’s guide to video conferencing and collaboration

Download -

E-Handbook

A Computer Weekly buyer’s guide to next-generation retail technology

Download -

E-Handbook

A Computer Weekly buyer’s guide to application modernisation

Download -

E-Handbook

Cloud applications boost agility, productivity for APAC businesses

Download

-

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

A Computer Weekly buyer’s guide to communications as a service

Download -

E-Handbook

A Computer Weekly E-Guide to Network Management & Monitoring

Download -

E-Handbook

The rise of edge computing

Download

-

E-Handbook

Ofcom raise over £1.3bn in new 5G spectrum auction

Download -

E-Handbook

How virtual desktops simplify end user computing during lockdown

Download -

E-Handbook

Application Delivery Network Buyer's Guide

Download -

E-Handbook

A Computer Weekly buyer’s guide to networking for the modern workplace

Download

-

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

Beginner's guide to Internet of Things

Download -

E-Handbook

A Computer Weekly buyer’s guide to satellite broadband

Download -

E-Handbook

A Computer Weekly buyer’s guide to communications as a service

Download

-

E-Handbook

Royal Holloway: Security evaluation of network traffic mirroring in public cloud

Download -

E-Handbook

A Computer Weekly E-Guide to Network Management & Monitoring

Download -

E-Handbook

A Computer Weekly e-guide on Network Visibility, Performance and Monitoring

Download -

E-Handbook

CW Innovation Awards: Jio Platforms taps machine learning to manage telco network

Download

-

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

The ultimate guide to identity & access management

Download -

E-Handbook

How do cybercriminals steal credit card information?

Download

-

E-Handbook

Beginner's guide to Internet of Things

Download -

E-Handbook

The future is SASE: Transform your enterprise network for good

Download -

E-Handbook

A Computer Weekly buyer’s guide to satellite broadband

Download -

E-Handbook

Royal Holloway: Security evaluation of network traffic mirroring in public cloud

Download

-

E-Handbook

Royal Holloway: Secure multiparty computation and its application to digital asset custody

Download -

E-Handbook

Top 10 networking stories of 2021

Download -

E-Handbook

The CISO's guide to supply chain security

Download -

E-Handbook

A Computer Weekly E-Guide to Network Management & Monitoring

Download

-

E-Handbook

The future is SASE: Transform your enterprise network for good

Download -

E-Handbook

VoIP has never lost its voice: How to get the most out of your business communications

Download -

E-Handbook

The development of wired and wireless LANs in a hybrid work model

Download -

E-Handbook

How to achieve network infrastructure modernization

Download

-

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

Top 10 ANZ IT stories of 2022

Download -

E-Handbook

Top 10 ASEAN IT stories of 2022

Download -

E-Handbook

Guide to building an enterprise API strategy

Download

-

E-Handbook

10 metaverse use cases for IT and business leaders

Download -

E-Handbook

A guide to continuous software delivery

Download -

E-Handbook

CW Innovation Awards: Bharti Airtel taps OpenStack to modernise telco network

Download -

E-Handbook

CW Innovation Awards: How DBS is transforming credit processes

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

CrowdStrike outage explained: What happened and what can we learn?

Download -

E-Handbook

Implementing GenAI: Use cases & challenges

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

Removing barriers to tech careers

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Collaboration vital for making DEI progress

Download

-

E-Handbook

Computer Weekly 2024 salary survey

Download -

E-Handbook

The importance of getting everyone involved in the diversity drive

Download -

E-Handbook

Infographic: How organisations are using generative AI in EMEA

Download -

E-Handbook

Infographic: How organizations are using generative AI in Asia-Pacific

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

Implementing GenAI: Use cases & challenges

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

Implementing GenAI: Use cases & challenges

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download

-

E-Handbook

The pros & cons of AI in cybersecurity

Download -

E-Handbook

The future of API management: Key trends for IT leaders

Download -

E-Handbook

Top tech stories of 2024: ASEAN (Part 1)

Download -

E-Handbook

A Computer Weekly buyer’s guide to automation and autonomous control

Download

-

E-Handbook

Top 10 ANZ IT stories of 2022

Download -

E-Handbook

Top 10 India IT stories of 2022

Download -

E-Handbook

Guide to building an enterprise API strategy

Download -

E-Handbook

A guide to continuous software delivery

Download

-

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

10 metaverse use cases for IT and business leaders

Download -

E-Handbook

The rise of SD-WANs: Time to cross the chasm

Download -

E-Handbook

Infographic: 4 key SD-WAN trends to watch in 2022

Download

-

E-Handbook

A Computer Weekly buyer’s guide to emerging technology

Download -

E-Handbook

A Computer Weekly e-guide to WAN & applications services

Download -

E-Handbook

A Computer Weekly E-Guide to Network Management & Monitoring

Download -

E-Handbook

Essential Guide: How APAC firms can ride out the pandemic

Download

-

E-Handbook

Infographic: 5 considerations before buying data center backup software

Download -

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download -

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download

-

E-Handbook

A Computer Weekly buyer’s guide to computational storage and persistent memory

Download -

E-Handbook

AWS vs Azure vs Google: 5 key benefits each for cloud file storage

Download -

E-Handbook

A Computer Weekly buyer’s guide to intelligent workload management

Download -

E-Handbook

IT Priorities 2020: Covid-19 consolidates storage push to cloud

Download

-

E-Handbook

On the bug side cartoon collection – 2025: Inflating, Inflating, the AI bubble

Download -

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

Hybrid cloud connectivity best practices

Download -

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download

-

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download -

E-Handbook

Understanding Kubernetes to build a cloud-native enterprise

Download -

E-Handbook

A Computer Weekly buyer’s guide to computational storage and persistent memory

Download

-

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download -

E-Handbook

A Computer Weekly buyer’s guide to sustainable datacentres

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download -

E-Handbook

Understanding Kubernetes to build a cloud-native enterprise

Download

-

E-Handbook

A Computer Weekly buyer’s guide to computational storage and persistent memory

Download -

E-Handbook

Executive Interview: Tapping APAC's storage potential

Download -

E-Handbook

A Computer Weekly buyer’s guide to containerisation in the enterprise

Download -

E-Handbook

A Computer Weekly buyer’s guide to colocation

Download

-

E-Handbook

Innovation Awards APAC 2025

Download -

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

Beginner's guide to Internet of Things

Download

-

E-Handbook

A Computer Weekly buyer’s guide to communications as a service

Download -

E-Handbook

Infographic: 5 differences between call centers and contact centers

Download -

E-Handbook

CW Innovation Awards: Bharti Airtel taps OpenStack to modernise telco network

Download -

E-Handbook

CW Innovation Awards: Jio Platforms taps machine learning to manage telco network

Download

-

E-Handbook

The enterprise guide to video conferencing in 2023

Download -

E-Handbook

VoIP has never lost its voice: How to get the most out of your business communications

Download -

E-Handbook

A Computer Weekly buyer’s guide to communications as a service

Download -

E-Handbook

Infographic: Zoom vs Teams vs Cisco

Download

-

E-Handbook

Essential Guide: How APAC firms can ride out the pandemic

Download -

E-Handbook

The rise of edge computing

Download -

E-Handbook

Ofcom raise over £1.3bn in new 5G spectrum auction

Download -

E-Handbook

A Computer Weekly Buyers Guide to IoT

Download

-

E-Handbook

A Computer Weekly buyer’s guide to hybrid cloud storage

Download -

E-Handbook

Oracle cloud applications exhibit pragmatic adoption curve

Download -

E-Handbook

A Computer Weekly buyer’s guide to computational storage and persistent memory

Download -

E-Handbook

A Computer Weekly buyer’s guide to colocation

Download

-

E-Handbook

AWS vs Azure vs Google: 5 key benefits each for cloud file storage

Download -

E-Handbook

Kubernetes: What enterprises need to know

Download -

E-Handbook

IT Priorities 2020: Covid-19 consolidates storage push to cloud

Download -

E-Handbook

Eyes on India: New age of flash storage boosts performance & efficiency

Download

-

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

The development of wired and wireless LANs in a hybrid work model

Download -

E-Handbook

Infographic: 4 key SD-WAN trends to watch in 2022

Download -

E-Handbook

Top 10 networking stories of 2021

Download

-

E-Handbook

An evaluation of the UK’s cyber security and privacy legislative framework

Download -

E-Handbook

CISO Success Stories: How security leaders are tackling evolving cyber threats

Download -

E-Handbook

How do cybercriminals steal credit card information?

Download -

E-Handbook

Top 10 ANZ IT stories of 2022

Download

-

E-Handbook

Guide to building an enterprise API strategy

Download -

E-Handbook

Headline: Royal Holloway: Attack mapping for the internet of things

Download -

E-Handbook

Royal Holloway: Cloud-native honeypot deployment

Download -

E-Handbook

Royal Holloway: Information security of the 2016 Philippine automated elections

Download

-

E-Handbook

Digital Transformation Unleashed: Smart Industries, AI & the 5G Revolution

Download -

E-Handbook

A Computer Weekly buyer’s guide to network cost and bandwidth optimisation

Download -

E-Handbook

Beginner's guide to Internet of Things

Download -

E-Handbook

The development of wired and wireless LANs in a hybrid work model

Download