Fotolia

Top 10 telecoms stories of 2025

The telecoms market has delivered a wave of innovation over the course of the past 12 months, but in 2025 the sector shifted focus with eyes very much on the skies. Find out more in Computer Weekly’s top 10 telecoms stories of 2025

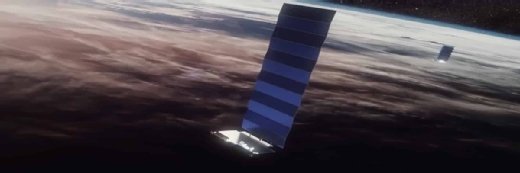

Generally, reviews and analyses of the telecoms market have been very grounded and focused on gigabit fibre networks and 5G mobile. But any look at 2025 would not be complete if it didn’t show just how much service providers and the industry in general are now increasingly and literally reaching for the stars – to be more precise, the looking at the burgeoning satellite communications sector.

The upshot is that in 2025 non-terrestrial networks (NTN) and satellite connectivity moved very markedly from niche to mainstream, whether in rural broadband or direct-to-cell use cases. In terms of those driving the provider landscape, it was no surprise to see Starlink as having gained the highest orbit sealing with 44 partnerships, followed by AST SpaceMobile and Lynk.

Looking at use cases and geography, rural and enterprise broadband remained the dominant application, with the leading providers players enabling unmodified smartphones to connect in remote areas. Yet in-flight connectivity was perhaps one one of the most interesting applications.

In July 2025, Virgin Atlantic announced plans to introduce Starlink in-flight connectivity across its entire fleet by creating a digitally connected cabin. Months later, arch rival International Airlines Group (IAG) announced a partnership to implement Starlink connectivity for more than 500 aircraft across its fleet, which includes Aer Lingus, British Airways (BA), Iberia, Level and Vueling. Not to be outdone, Qatar and Emirates also inked deals with Starlink to equip widebody aircraft with connectivity.

After a previous year which marked its fifth birthday and the arrival of Advanced versions of the basic network, the 5G industry concentrated on deployment. And one of the most interesting developing market was in-stadium connectivity. Simply offering Wi-Fi in stadiums is not enough: providing an advanced connectivity experience is now what fans – both in music and sports – expect. Game-changing connectivity for stadiums includes integrating existing stadium infrastructure with 5G, cloud-based private telecom networks.

The year was rather quiet on the 6G front, but 2025 did end with research establishments in Europe, in particular Finland, setting out plans for what the next generation of mobile will look like.

For fixed broadband access in the UK, the year saw continued rapid pace of gigabit access. A report from regulator Ofcom in November revealed that 78% of UK homes (23.7 million) had full-fibre broadband access, up from 20.7 million (69%) a year ago. Yet Ofcom also noted that less than half of those with access sign up. Alternative providers were also facing increased business headwinds that are expected to continue into the new year.

Here are Computer Weekly’s top 10 telecoms stories of 2025.

1. NTN operator–satellite partnerships now in 80 territories

GSA study shows Starlink leading the satellite landscape with 44 partnerships, followed by AST SpaceMobile and Lynk, while in spectrum Ka-band remains most widely used frequency range, supporting both feeder and service links.

The findings point to an evolving landscape where satellite services are moving from niche to mainstream, with strong growth expected in broadband and direct-to-cell offerings, and slower but steady expansion in IoT applications

2. Viasat hails ‘revolution’ for global satellite IoT

Satellite communications firm launches its next-generation internet of things connectivity service, which it says is set to revolutionise global IoT capabilities with two-way messaging connectivity.

The IoT Nano service is designed to address a growing demand for cost-effective, low-data, low-power IOT services, enabling businesses across sectors such as agriculture, transport, utilities and mining to effectively monitor and control fixed and mobile assets with what is claimed as “ultra-reliable” satellite coverage.

3. AST SpaceMobile hits launch button on satellite expansion

As part of its mission to build the first and only space-based cellular broadband network accessible directly by everyday smartphones for commercial and government applications, AST SpaceMobile reveals plans to expand its satellite fleet by almost 10 times over the next 18 months.

Specifically, the space-based cellular broadband network provider as part of a programme to send 45 to 60 satellites into orbit by 2026 to support continuous service in the US, Europe, Japan and other strategic markets.

4. Qatar Airways claims Starlink in-flight connectivity benchmark

MENA airline accelerates programme to equip widebody aircraft with Starlink-based connectivity and now operates up to 200 daily such connected flights to key destinations.

Qatar Airways claims to be the operator of the largest number of Starlink-equipped widebody aircraft and the only carrier in the MENA region currently offering Starlink in-flight connectivity. It has described the expansion as “reaffirming its position as the world’s leading airline for innovation, reliability and unmatched passenger experience

5. Swissto12, Astrum Mobile hit satellite preliminary design milestone

Preliminary design review revealed for Astrum Mobile’s Neastar-1, said to be the first geostationary satellite-to-device mission in the region designed to change how mobile networks reach people across Asia Pacific.

Neastar-1 is being developed on Swissto12’s HummingSat new geostationary small satellites that are seen as offering new economics for the geostationary satellite market, being around five times smaller than traditional satellites and so unlocking faster builds, lower costs and ride-share launches. The range is also said to offer a telecoms-grade service backbone that plugs directly into the 3GPP non-terrestrial networks (NTN) standard, designed for mass-market adoption.

6. Fibre flies as improved 5G sees record UK mobile data consumption

As the country’s mobile comms operators increase the reach and roll-out of 5G standalone networks, the UK has become a mobile data-hungry nation, with mobile users consuming nearly a fifth (18%) more mobile data than a year ago, according to research from communications regulator Ofcom.

The research found UK mobile data use climbs to over 1.2 billion gigabytes each month, as networks deliver 5G SA to 83% of the UK to meet rising demand.

7. Nokia readies for comms AI super cycle with R&D facility

The city of Oulu in Finland has received a further boost to its prestige in the field of mobile communications research, design and manufacturing, with Nokia’s opening of what it calls the new home of radio, in the form of a research and development hub for the entire lifecycle of 5G and 6G radio innovation that will design, test and deliver next-generation networks built for artificial intelligence (AI).

The new campus is claimed to contain some of the world’s most advanced radio network laboratory and manufacturing technology, and will provide both simulated and real-world field verification environments to accelerate network evolution, ensuring that secure 5G and 6G networks are designed, tested and built in Europe.

8. UK full-fibre overtakes FTTC for first time

The UK’s broadband sector has quietly witnessed a tipping point as fibre-based connections direct to premises superseded kerb-side connectivity for the first time, according to analyst Point Topic, while two of the country’s leading independent broadband service providers (altnets) have geared up fibre offerings for businesses.

The Point Topic survey found that the UK broadband market overall regained momentum in the third quarter of 2025, adding 64,000 subscribers and returning to growth across a total base of 28.94 million lines. Most significantly, full-fibre (FTTP) adoption surged ahead at its fastest rate since nationwide roll-outs began, reaching 11.56 million connections and overtaking fibre to the cabinet (FTTC) for the first time, with the latter decreasing to 10.6 million.

9. 5G Standalone growth spurs differentiated connectivity services

Mobility Report shows 33 CSPs currently offer differentiated connectivity services based on network slicing, with a combined total of 65 offerings with around 1.4 billion people expected to be served by fixed wireless access.

10. UK altnet market ‘entering its most dangerous phase yet’

Even though the footprint of the UK’s alternative broadband providers (altnets) has doubled in less than two years, the sector is now moving from expansion to survival, with several operators facing commercial pressure that could trigger an expected consolidation wave, a study from Intelligens Consulting has found.

The State of the UK fibre market 2025 report revealed that the UK broadband market is on the brink of its biggest shakeout yet, as the industry shifts from rapid expansion to targeted, commercially grounded fibre investment.