CloudBolt analysis: Mass VMware exodus yet to come, but unwind underway

Two years after Broadcom’s acquisition of VMware, the fact that organisations are considering leaving VMware is (of course) not news.

But, according to cloud cost optimisation company CloudBolt Software, there is more to the story.

Known for its hybrid cloud management services and skills, CloudBolt has delivered a new report entitled “The Mass Exodus That Never Was: The Squeeze Is Just Beginning” in an attempt to provide more colour to the story and examine how enterprises are responding.

The report suggests that while the predicted “immediate stampede” away from VMware did not quite materialise as envisaged, organisations are “actively unwinding dependence” in a measured workload-by-workload transition.

Transition conditions

That more measured transition is shaped by pricing concerns, operational complexity and mounting executive scrutiny.

“Two years ago, the market was dominated by knee-jerk speculation and worst-case projections,” said Mark Zembal, chief marketing officer at CloudBolt. “This latest study separates noise and speculation from reality. The fear has cooled, but the pressure hasn’t – and most teams are now making practical moves to build leverage and optionality – even if for some that includes the realisation that a portion of their estate never moves off VMware.”

Zembal says that his firm’s research highlights three numbers that capture the market’s shift from fear to sustained pressure to action:

- 2024 Fear: 73% expected VMware costs to more than double — yet only 5% of respondents to this most recent study have seen 100%+ increases.

- 2026 Reality: 88% are concerned about future price increases, and say it is shaping decisions now as the real squeeze begins.

- The Action: 86% report they are actively reducing their VMware footprint.

To put a finer point on overall sentiment, one survey respondent commented, “The process of unwinding a decade of process dependencies is taking 18-24 months. This sideways abstraction is far more complex than a standard cloud lift-and-shift, leading to a significant loss of confidence in our ability to exit quickly enough to avoid the next renewal cliff.”

Slow unwind

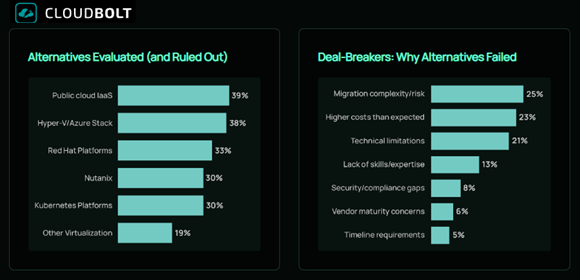

Additional findings underscore why the “slow unwind” is becoming the dominant operating model.

Over half of companies say they have changed their VMware strategy two or more times since the acquisition, reflecting a market still recalibrating and experimenting in real time.

“Enterprises aren’t just asking what they want to do – they’re confronting what they can execute safely,” said Rod Squires, CEO of CloudBolt. “The panic phase is over. Now it’s execution: reducing dependency, managing dual realities during transition, and building optionality before the next renewal decision tightens the window – and slams the budget.”

Two years in, it appears that most firms view their VMware strategy as a priority business-level decision, not just a technical one.

This research surveyed IT decision-makers (director level and above) with primary decision-making authority over VMware-related decisions at companies with 1,000+ employees and data was collected in January 2026 via structured surveys and qualitative interviews.