Dutch bank ING sees financial boost from employee performance management rethink

ING claims business has improved after replacing ‘scattered and fragmented’ IT systems to change the way it manages employee performance

Dutch bank ING claims a project to redesign the way it manages the performance of its 55,000 employees has helped it to push its financial returns above the average for the top 500 listed companies.

The company began redesigning the way it manages staff performance in 2015, after a benchmarking exercise revealed it was lagging behind competitors in the way it assessed the performance of its employees and kept them motivated.

The way ING managed performance targets was “scattered and fragmented”, ING’s global head of HR strategy and transformation, Luigi Maria Fierro, told Computer Weekly. “We were using more than five IT systems, we had more than 10 different processes, we had different timelines, different elements of the process, different logic.”

ING was in the throes of an €800m project to harness digital technology and re-engineer its business to compete with emerging financial technology (fintech) companies. It has introduced agile ways of working, including reorganising the workforce into self-directing teams.

The project included a programme to replace 250 incompatible human resource (HR) systems across nearly 50 countries with cloud-based HR technology, supplied by Workday, by 2020.

But Fierro said the choice of technology was less important than the need to change the culture of the organisation to create a more accountable, more motivated workforce.

“The system for me is the least of the problem. Information technology is a factor, a catalyst, but it is never a solution,” he said, speaking ahead of the Unleash World Conference on HR and technology. “You can use SuccessFactors, you can use Workday, you can use Oracle, whatever. It is not the key to success.”

Health checks

The project began when ING ran a benchmarking exercise from management consultancy McKinsey – Fierro’s former employer – in 2015 and 2016.

The exercise, known as the Organisational Health Index (OHI), compared ING’s performance across multiple parts of the business with the performance of other financial services companies.

“The technology is a key enabling factor. It is not solving the issue, but without the right technology in place, all our efforts are going to fail”

Luigi Maria Fierro, ING

The survey showed that ING needed to change the way it managed the performance of employees and, said Fierro, “create a performance culture” – if it was to match its peers.

“It was not a matter of adjusting [what we had], it was a matter of redesign,” he said.

The importance of stretching

ING decided to replace its existing performance management process, which looked at employee performance over the previous year, with a process that enabled managers to give employees continuous feedback.

For Fierro, one of the keys to the project was to encourage employees to set their own goals, which led them to stretch and improve their skills and capabilities.

“If you want to constantly improve your performance, you have to positively stretch yourself, like an athlete. You have to put some passion in to be motivated. You have to invest,” he said.

Warm-up exercise

ING began with a pilot project with its managers in Spain. The territory was small enough so that any teething troubles were unlikely to cause wider problems.

The pilot showed that it would take a lot more to change the mindset of the organisation than Fierro had anticipated. “You have to accept a longer learning path than expected,” he said.

Each manager received 10 hours of training on performance management, delivered in just-in-time chunks. But this was not enough, according to Fierro.

It became clear that it was important to repeatedly tell managers and employees why the company needed to make changes to its performance management process.

It took two-and-a-half years to deploy the new performance management processes across the company, with the final region joining at the beginning of 2018.

ING is using a combination of IT services from Workday, SuccessFactors and SAP to manage the process, but plans to move fully over to Workday once it is deployed company-wide.

The IT department faced some challenges adapting ING’s performance management processes for three IT systems, but Fierro said the more difficult task was to improve the company’s performance culture.

“There are some nuances on the experiences we can provide to employees [on different technologies], but the core of the process is there,” he said.

Improving performance

The bank shied away from the traditional practice of awarding numeric scores to assess the performance of its employees.

These systems often place artificial limits on how many top scores managers are allowed to award, which creates a “normalised curve” of results across the employee base.

Instead, ING awards employees one of three levels: excellent, well done, or improvement. Because of the way teams are structured in ING, employees have frequent contact with managers, which makes it possible to receive regular feedback, he says.

Better health

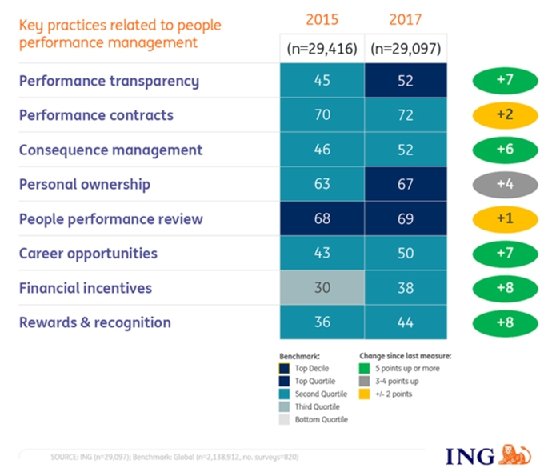

The project led to improvements in ING’s score on the OHI when the company repeated the process in 2017.

There is a strong correlation between financial companies that do well in OHI and their financial performance, said Fierro. “Banks and financial companies with higher OHI results inevitably show higher returns on investment.”

By 2017, ING’s total return to shareholders was higher than the average for Standard and Poor’s 500 index of companies, and almost significantly higher than leading competitors, said Fierro.

The bank’s OHI score moved from the second quartile in 2015 to the top quartile in 2017. OHI performance transparency, personal ownership and people performance also moved into the top quartile.

The survey has shown that employees and managers buy in to their targets and feel accountable for meeting them, he said.

Target practice

Next, Fierro wants to work with ING’s analytics team to identify the best way to set targets and goals.

The way people define the target and write it down shows how engaged they are and how likely they are to succeed.

Analytics technology should be able to help staff set goals they are more likely to achieve and which are more likely to inspire them.

Fierro also has plans to use analytics to identify variations in how much feedback managers give in different geographic areas, or to different genders – to identify where there are gaps in the feedback process.

For ING, the most important step in the project was not the choice of technology, but developing the right strategy for changing the way the company manages performance.

“The technology is a key enabling factor. It is not solving the puzzle, it is not solving the issue, but without the right technology in place, all our efforts are going to fail,” he said.

Read more about HR technology

- Qatar-based logistics firm Gulf Warehousing Company introduces smart appraisals for employees, cuts the time it takes to recruit and gives staff and managers access to accurate HR data by replacing paper systems with human resources software.

- Business leaders say their human resource IT programmes are leading the way to the wider deployment of digital and cloud technology across their organisations.

- Aviation group Lufthansa is confident of landing a company-wide IT project following a sometimes turbulent journey.

Luigi Maria Fierro will be speaking at the Unleash World Conference and Expo in Amsterdam on 23-24 October 2018.