Eisenhans - Fotolia

IT Priorities 2020: Cloud storage key but SAN/NAS alive and well

In the Computer Weekly/TechTarget IT Priorities survey cloud dominates storage spending priorities for 2020, but on-premise technologies such as SAN and NAS are still key to IT

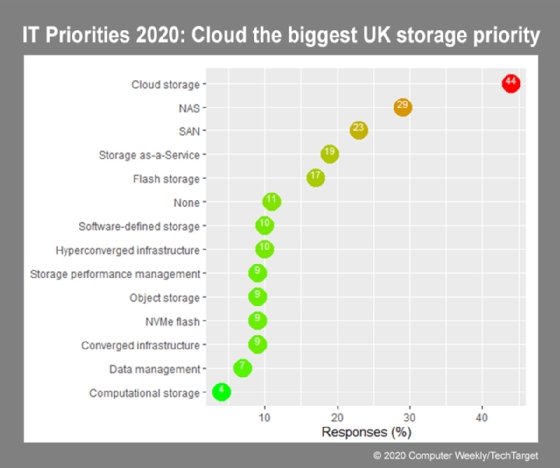

Use of the cloud will dominate storage and backup projects in 2020. That’s according to questions about storage and backup in the Computer Weekly/TechTarget IT Priorities survey, which asked around 3,500 IT decision-makers worldwide, and 383 in the UK, about likely spending in 2020.

Asked what storage technologies they expected to deploy in 2020, the largest number of UK respondents (44%) said cloud storage.

SAN and NAS still in the game

That’s not to say “traditional” on-premise storage technologies are down and out, however. Nearly one-third (29%) said they would deploy file access network-attached storage (NAS) this year, while not far off a quarter (23%) said they would deploy block access storage area network (SAN) hardware in 2020.

Meanwhile, 17% said they would deploy flash solid-state media and 9% said they would deploy superfast NVMe flash storage. The survey didn’t ask about mechanical hard disk drives (HDDs).

Can we infer anything about the proportion of solid-state drive (SSD) to HDD deployment in storage arrays for the year? Probably not, because it’s likely that a good chunk of the figures for flash deployment relate to storage deployments in server hardware rather than shared storage.

Object storage – useful for unstructured data and a key method of cloud storage – was likely to be deployed by 9% of respondents in 2020, the survey found.

Shift to the cloud

Further evidence of the shift towards the cloud was shown in responses to other questions.

Asked to describe their IT environments in 2020, the largest number (43%) said on-premise, but 26% said hybrid cloud and 20% said multicloud. Given that hybrid cloud and multicloud encompass on-prem, we can infer that customers’ own sites are not in danger of being eclipsed by pure cloud operations any time soon.

When asked what activities would most affect their organisation’s 2020 IT spending, 41% said cloud infrastructure deployments (public, private, hybrid), which was the largest single area, just in front of network and infrastructure modernisation (36%) and security (35%).

When respondents were questioned about where their 2020 budgets would increase, cloud services (38%) came second only to that perennial concern, security and risk management, which was indicated by 53%.

Meanwhile, nearly half (47%) said use of cloud services would support their implementation of digital transformation in the year ahead.

Backup and disaster recovery was indicated as an area where budget spending would increase by 19% of those questioned, but a fair bit of that will likely be via the cloud (see below).

On-premise storage was marked as likely to account for an increase in spending by only 6% of those questioned. By way of a comparison, only 10% expected spending to increase on on-premise servers. Both these figures probably reflect the growing use of the cloud for storage and servers.

Backup and disaster recovery: As-a-service prominent

Use of the cloud is hugely evident in respondents’ answers to questions about backup and data protection too.

Backup hardware was indicated as the priority for data protection spending by 27% of those questioned, and that presumably means on-premise. Meanwhile, however, backup as a service will be a spending priority for 23% and disaster recovery as a service for 10%. Disaster recovery was by far the biggest priority in this category of questions – with 50% responding positively – but there was no breakdown of the proportion of this that would be delivered on-site or via the cloud.

Read more about cloud storage

- Cloud storage’s low-hanging fruit: We look at the use cases most suited to a quick transition to the cloud such as backup, archiving, disaster recovery, file storage and cloud bursting.

- Cloud storage and its main cost components. The main items charged for by the big cloud storage providers, such as capacity, storage type, transactions, data egress, networks and data protection.

Meanwhile, flying the flag for “traditional” media is tape infrastructure deployment – still a viable choice in archiving – which will be part of plans in 2020 for 7% of those questioned.

A fifth (21%) aim to spend money on endpoint backup in 2020, while 13% will target ransomware protection.

2020 versus 2019

So, how do all these figures compare with last year?

Questions for storage priorities weren’t asked under the same headings last year so a direct comparison is not possible. Instead, the survey asked about “primary storage” priorities, and the cloud featured heavily among those, with cloud backup as a service top of the list (33%) while 26% said public cloud storage would be a priority (a close fourth place in the list).

When asked about SAN, NAS and object storage in 2019, the numbers were roughly similar.

About one-fifth planned SAN and NAS projects in 2019 (21% and 19% respectively), which was less than this year, where the two mainstream access methods registered 23% and 29% of interest respectively.

Last year, those that planned object storage deployments were 12% of the total, and this year that’s down to 9%, though that difference is probably not statistically relevant.

Hyper-converged infrastructure (HCI) was much more prominent in last year’s survey. It was listed as a key primary storage initiative for 2019 by 14% of respondents, although elsewhere in the survey 21% said they would use hyper-converged infrastructure in production and 67% said they expected the share of HCI in their organisation’s compute capacity to increase.

In 2020, respondents were asked whether they plan to deploy it as a storage technology and under a general infrastructure category and the responses were 10% and 9% respectively.

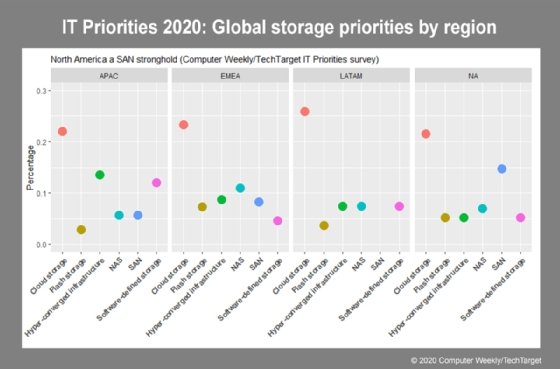

Global storage view: North America a SAN stronghold

When we take a look at the top storage priorities across four global regions – EMEA (Europe, the Middle East and Africa), North America, Asia-Pacific and Latin America – there are some big similarities, but also some interesting differences.

Key among the similarities is that the cloud is important to organisations’ storage plans everywhere. On every continent, cloud storage was chosen as the top storage priority for 2020 by the most respondents, with somewhere between the low to mid-20s in percentage terms recorded.

The next most popular choice varied by continent. In North America it was SAN, with a shade under 15%, nearly double any other region. In APAC it was hyper-converged infrastructure (HCI), where it was top priority for 13.5% of those questioned. In North America, HCI was least popular.

The connection between those numbers may be that the US tends to have larger businesses, and so larger-scale SAN shared storage could be more prevalent for that reason. By the same token, those regions where smaller business units (possibly remote locations of EMEA and North American organisations) may find hyper-converged infrastructure more suited to their needs.

In EMEA NAS comes second to cloud storage, and it is in this region also that flash storage is more likely to be a key storage project than elsewhere.