k_yu - stock.adobe.com

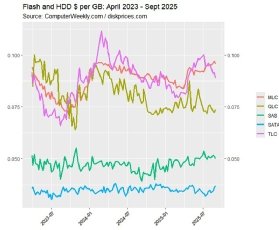

Flash drive prices grow quickly while SAS and SATA diverge

Manufacturers have throttled back production of flash drives to tackle over-supply and it shows in rising prices

Solid-state drive (SSD) prices per gigabyte (GB) have headed sharply upwards over the past two quarters.

Meanwhile, on the spinning disk front, SAS hard disk drive (HDD) prices increased in price and SATA stayed stable, to leave an increased gap between the two.

SSD prices had been predicted to increase as manufacturers slowed production in an ongoing effort to raise prices that had dropped away during a long period of surplus production.

Meanwhile, SAS drive prices also increased while SATA spinning disk price per gigabyte stayed steady. The net effect is for the SAS side of the scissors to move upwards and away from SATA.

Possible causes include a similar situation of oversupply that is now working its way out as manufacturers cut back on production. Also, SAS is the more performant of the two HDD types and may be in greater demand for large-scale data storage for artificial intelligence (AI).

During the past two quarters, Flash drive prices (MLC, TLC and QLC) increased from $0.079/GB to $0.086/GB, an 8.8% increase. If we take QLC out of the equation – because of a low sample size in the data (see below) – that rises to $0.093/GB and a 17.7% increase. The reality probably lies between the two.

Also, during the past two quarters, SAS spinning disk prices per gigabyte rose from $0.049 to $0.051, an increase of just over 4%. Across the year, however, the increase has been from $0.041 to $0.051, nearer 25%.

SATA drive prices – the less performant of the two protocols – have remained steady. SATA price per gigabyte six months ago was $0.035 and is now $0.036.

The reason for the big increase in SAS prices also lies in a recent history of overproduction being throttled back to help the price by manufacturers, and likely higher demand for performance-hungry AI applications.

It must be noted that HDD is still the dominant medium in data storage in 2025.

Flash prices hit a ceiling in late 2023 and early months of 2024 when manufacturers slowed production to try to raise prices and boost profitability. SSD prices per gigabyte reached an average of $0.095 in April 2024, which was a rise of 26.67% from autumn 2023.

At the time, many thought SSD prices would achieve even greater highs in 2024, but while production increased, customer demand did not, and prices decreased.

These figures are from exclusive analysis by Computer Weekly that gathers drive prices aggregated by Diskprices.com (see graph) every week from Amazon.com. Since March 2023, more than 84,000 drive prices and specs have been gathered, with averages calculated every week for TLC, QLC and MLC/unspecified flash drives, as well as SAS and SATA spinning disk.

Diskprices.com aggregates new drive prices that it takes from Amazon.com, with more than 700 disk prices and specifications processed every week. Data is then filtered by flash and spinning disk type, and the average price per gigabyte calculated.

The analysis is based on Amazon.com prices, which are mostly aimed at consumers and SME customers, and therefore lacks, for example, much representation of QLC flash, which is aimed at use cases that require predominantly sequential access and offer greater density.

Having said that, the volume of data gathered helps to show trends in drive pricing. We use it here as a proxy for drive prices because of the absence of price data from enterprise drive and storage array makers.

Price per gigabyte is a major consideration for customers, but total cost of ownership over a drive’s lifecycle is also important, with purchase cost, energy usage and maintenance costs key among them.

Data gathered covers drives that range in capacity from less than 1TB (terabyte) up to 30TB for HDDs and up to 12TB for SSDs.

SSD costs more per drive to buy than spinning disk, but maintenance costs are often lower. Cloud storage provider Backblaze publishes reliability figures for the 300,000-plus drives in its estate. It found its SSD annual failure rate (AFR) to be 0.9% in mid-2023. There have been no AFR stats for SSDs from Backblaze since, but for HDDs, the figure for 2024, reported in February 2025, was 1.57%.

Read more about flash and disk drives

- HDDs to remain dominant storage footprint in 2025: HDDs will retain their top storage spot in the new year despite advances in flash, analysts say.

- Storage technology explained – flash vs HDD: In this guide, we examine the differences between flash storage and HDD, the rise of NVMe and much denser formats such as QLC, and whether or not flash will vanquish HDD in the all-flash datacentre.