SAP sales tactic fuels IT disconnect

Business heads are being targeted by SAP as it pushes out its Rise cloud ERP system

SAP’s sales tactic of circumventing IT and enterprise resource planning (ERP) teams to go directly to business heads when selling its Rise cloud ERP product is putting pressure on IT leaders, analyst Gartner has warned.

Among the key challenges is SAP’s ambition to reduce customisation of the core ERP system, which simplifies upgrades but limits the ability to adapt the ERP to meet unique business requirements.

IT leaders are also likely to face practical hurdles when looking at how SAP Business Transformation Platform, which is part of Rise, can be deployed to move data in and out of the SAP system.

According to Gartner, it is only available in a limited number of cloud regions, which not only poses challenges related to latency but also raises data sovereignty concerns. In addition, IT leaders will need to account for data transfer costs incurred when moving data off the SAP cloud to other enterprise systems.

SAP’s latest results shows that its quarterly cloud revenue is reaching $5bn, an increase of 26%. According to a transcript of the earnings call posted on Seeking Alpha, CEO Christian Klein sees the migration of SAP customers to the company’s cloud subscription services as a key growth opportunity.

“Our very large cloud backlog and high recurring revenue share will be the foundation for double-digit total revenue growth in 2025 and for many years to come,” he said.

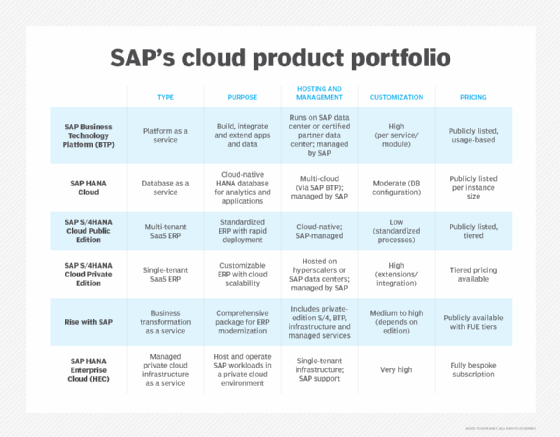

SAP Rise is very much part of this growth plan. SAP positions Rise as a business transformation system, which is sold as a subscription, and bundles S/4Hana and SAP’s Business Transformation platform (BTP) as part of the full service.

During the company’s latest earnings call, Klein said: “For all customers on their Rise journeys, we have been accelerating time to value while reducing the implementation costs of SAP projects with excellent AI tools.”

SAP is giving businesses a 50% discount to upgrade to the Rise platform, an incentive which has been applauded by the German SAP user group DSAG (Deutschsprachige SAP-Anwendergruppe).The user group had previously been critical of SAP’s plans to offer innovations such as artificial intelligence (AI) and a green ledger only on Rise.

While the product bundle does offer some organisations the ability to get value out of their SAP systems quicker, according to Gartner, SAP customers have reported that their senior management signed contracts without sufficient prior due diligence or a comprehensive understanding of how and whether Rise with SAP aligns with the organisation’s needs.

In a report, Our organization committed to Rise with SAP: What now?, Gartner noted that this leads to IT teams struggling to satisfy the directives from the business while simultaneously ensuring that the new system is compatible with existing infrastructure and organisational priorities.

Although Rise is a managed service, Gartner said it has been told by Rise customers about the rigidity of the SAP delivery model. Unlike competitors’ managed service provider (MSP) services, Gartner said the split of responsibilities are not negotiable or adjustable to specific customer needs.

The authors of the Gartner report urged IT decision-makers to work with a systems integrator (SI) throughout the duration of the SAP Rise contract to create a bridge between the standardised approach of the Rise model and the organisation’s unique business process and workflow requirements.

“Check with your sourcing team and IT teams if there is already a list of preferred suppliers with whom you can have initial discussions or if the current outsourcer has the capabilities to support the organisation with Rise as well,” they wrote.

An SI can offer skilled SAP Basis programmers and service managers who are able to navigate the intricacies and rigidity of the Rise with SAP delivery structure. However, while an SI can help navigate the complexities of Rise with SAP, Gartner urged IT leaders who work with an SI to consider retaining at least in part or all their SAP Basis team. Keeping certain activities in-house could mitigate the risk of long-term lock-in with the selected third party and enhance operational continuity.

Service level agreements (SLAs) are also something that differ between MSPs and SAP' Rise. While MSPs tend to offer an SLA with 99.9% uptime, according to Gartner, Rise with SAP’s 99.7% SLA translates to a downtime of 2h 10m 24s each month. Higher availability is available at extra cost.

Another potential cost arises when organisations need to transfer data between their SAP Rise system and other enterprise applications. Gartner urged IT decision-makers to assess data transfer costs related to both ingress and egress from their organisation’s Rise account, along with any supplementary cloud services needed, such as transit gateways and virtual networks.

Read more stories about SAP Rise

- User groups give SAP’s 50% Rise incentive the thumbs up: SAP has changed tack, after the furore over its intention to make certain features available only to Rise customers on SAP Cloud.

- User group chair recommends long-term SAP Rise strategy: Independent UK and Ireland SAP User Group chair describes upgrade as a marathon, not a sprint, but says SAP Rise is also inevitable.