Improved debt collection with BI: An ICICI Bank story

Debt collection can gain immensely by BI. By powering this, ICICI Bank has effectively turned debt collection into a customer-relations management program.

In mid-2008, the credit control teams at ICICI Bank were confronted with a new set of challenges. Following the subprime mortgage crisis of 2007 in the United States, the world economy witnessed a slowdown. The effect of the subprime turmoil, that was once thought to be limited to the housing loans business, had started spreading to other sectors.

As risk levels accentuated, credit terms needed to be tightened. As a result, the banks were also required to deal with a new challenge of reduced liquidity, which was threatening to become a powerful economic decelerator. Deterioration in the macro-economic environment and the rising interest rates further intensified the challenges faced by banks; ICICI Bank was no exception.

Ensuring customer loyalty

Amidst these challenges, ICICI Bank had to ensure that its customers remained satisfied with its services and did not switch to its competitors. Debt collection was identified as the key process where a friendlier approach could result in improved customer satisfaction and loyalty. One of the important steps in the debt collection process was choosing the appropriate customer-approach channel for each case. ICICI Bank decided to use business intelligence (BI) to achieve this goal. (See box: A novel approach to debt recovery)

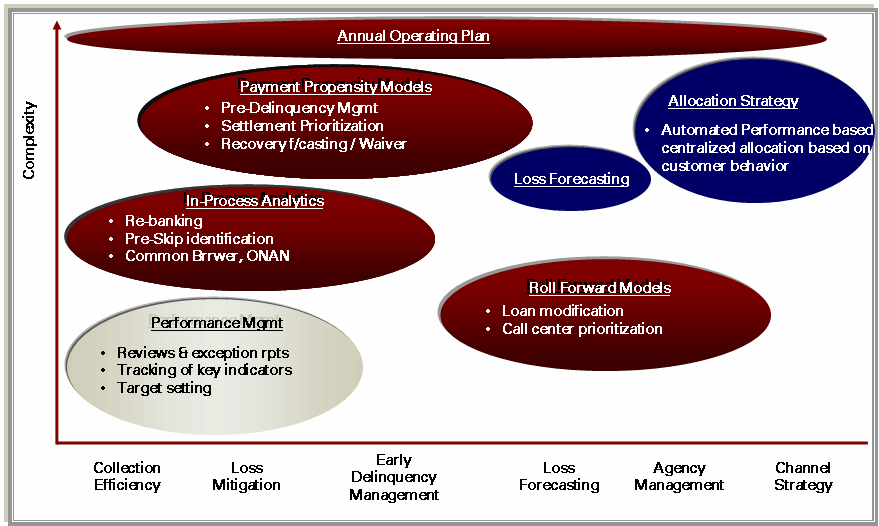

Figure 1. Span of Analytics Deployment

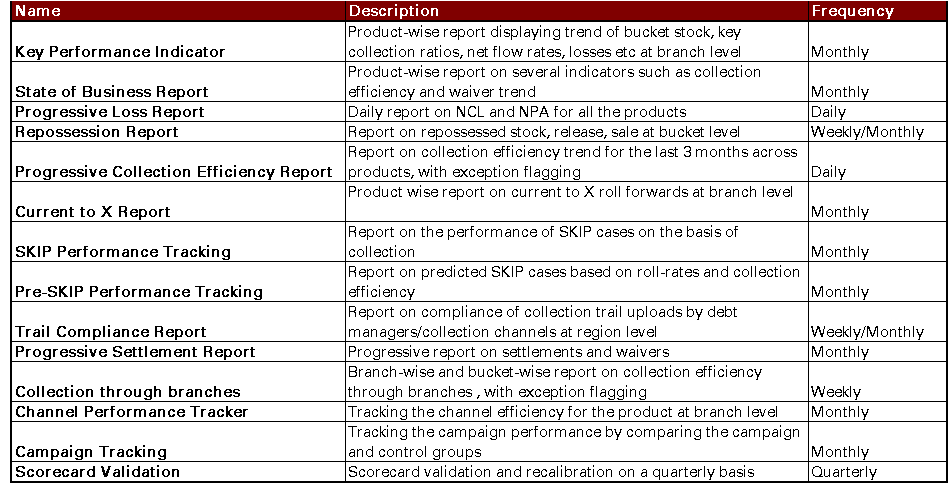

| A novel approach to debt recovery One of the most pertinent aspects that ICICI Bank had to pay attention to was debt recovery. Although the primary function of recovery agents is to ensure debt collection, the bank wanted to carry out the process delicately without losing its customers. Thus, the bank introduced customer-friendly practices, which, in addition to ensuring collection, were aimed at improving customer relationship and its own brand value. ICICI Bank’s defaulter bucket comprised serious delinquencies (high risk) and early delinquencies (low risk). The bank employed a ‘centralized debtors’ allocation model’ to allocate the right set of delinquent cases to the most appropriate collection channel. The bank uses multiple channels for debt collection. This includes non-intrusive channels such as SMS, e-mails, IVR, dunning letters, and reminder calls through the call centers, which are used to handle early delinquencies. The serious delinquents require a personal visit or may even need initiation of legal action. India, with its varied demographics and diverse customer segments, posed a challenge when it came to servicing the heterogeneous customer-base. The vastness of the Indian market resulted in heavy dependence on the field agencies for debt collections, unlike the western world, where majority of the delinquent pool is serviced by the call centers. The bank management, with the aim to transform debt collection as a customer retention tool, decided to use technology to achieve the objective. It employed analytical models developed with SAS that factored in several parameters such as efficiency of collector, customer profile, risk behavior, and exposure. For instance, low risk and low outstanding debtors may just need a gentle reminder, whereas high risk and high outstanding debtors need to be directly contacted via field agencies or bank employees. Figure 2. Reporting of the key parameters |

Technology used

Prior to theadoption of technology, over a thousand employees of the bank used to manually allocate around 30 lakh delinquent cases across more than 100 locations to around 2,500 channel partners based on subjective rules. However, the manual allocation proved inefficient, and the scale of the exercise called for an analytics-based solution.

ICICI Bank selected SAS to develop a ‘centralized debtors’ allocation model’ to allocate delinquent cases to the right channels till the last mile. Post the allocation, rules are run on SAS BI, which generates a reverse uploadable file that captures the details of each delinquent case and the channel and collector/collection agency to which it needs to be allocated. This data is made available to the collection work flow system (CAPS), which delivers the details of the case assigned to each individual.

The vendor was not involved during the deployment owing to lack of experience in the Indian debt collection process. However, post implementation, the vendor optimized the code and ensured that the solution complied with the international standards.

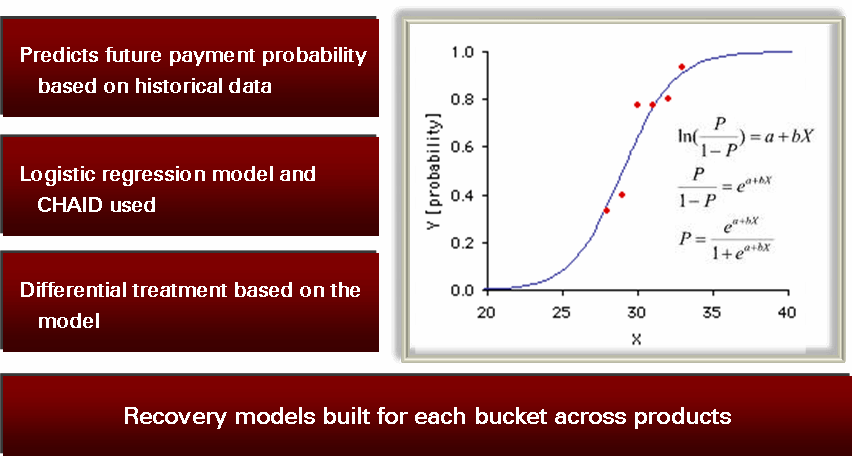

Figure 3. Recovery Models

Improved collection efficiency

Offering self-service and a multi-channel approach have improved efficiency in debt collection at ICICI Bank. Sridhar Ranganathan, DGM – Debt Service Management Group (DSMG) at ICICI Bank, observes, “The use of analytics has been a game changer for the DSMG at ICICI Bank. The BI unit (BIU) has played a vital role in important projects like centralized allocation and score cards. The project has resulted in a major shift in the DSMG strategy and improved collection efficiency. Projects like customer categorization have provided crucial insights for strategic decision making.” (See Box: Key processes where BI has proved helpful)

Tangible benefits

- Reduced credit loss: Debt collection performance improvement resulted in credit loss savings. In case of automobile loans, the bank achieved 50% increase in debt collection, thus experiencing substantial reduction in credit loss. More reduction could have been achieved as the centralized allocation was linked to team performance.

- Improved manpower utilization: Optimized allocation aided better utilization of manpower. Automated and centralized allocation, in case of credit cards and personal loans, could be done by using 80% less manpower.

- Reduced turnaround time (TAT): The TAT for allocation reduced from five to six days to three to four hours, thereby providing more time to collectors on field to resolve cases.

Intangible benefits

- Transparency: Since the allocation rules are agreed upon and deployed by a central team in line with business objectives, the system has become highly transparent.

- Customer delight: The use of soft touch channels for first time defaulters and cases with low outstanding amounts and allocating the same employees for customers availing multiple loans have reduced escalations and resulted in customer delight.

- Direct collections: The debt collection by bank employees (rather than the traditional model of collecting through trained agents) has increased by 78% in one of the asset products. With BI, high ticket and strategic customers could be identified quickly and offered better customer service.

| Key processes where BI has proved helpful Payment propensity/recovery models: The recovery models were based on parameters such as a customer’s payment history, risk exposure, cross-holdings, geographic location, and others. Customer behavior during the last 12 to 24 months was analyzed (depending upon the product and business objective) while building these models. These models help identify (and hence give differential treatment to) customers based on their payment propensity. The bank now has 10 payment propensity scorecards and 34 segmentation models across customer segments and products, built over two years. The models are updated on a monthly and quarterly basis factoring in the changing customer behavior and business dynamics. The scorecards are deployed using SAS. Pre-delinquency management: This is a critical strategy deployed for non-delinquent customers across products. It involves behavioral analysis of the potential defaulters to assess their credit orientation and worthiness. Traditional methods react to delinquency that has already occurred, whereas the pre-delinquency management gives an edge by raising an early alarm. Analytical models are developed to identify customers who have higher probability of going delinquent. Further, these customers are offered a wide range of services like soft reminders, SMS campaign, new payment schedule, and flexible credit limits. Loss forecasting: An important tool for risk management adopted by banks at a portfolio level. |

Using analytics across the spectrum in DSMG has brought about a number of efficiencies in the process. As Vyom Upadhyay, DGM – BIU at ICICI Bank points out, “The highlight of the debt collection project was the ability to understand the allocation logic across the country, and put that in a consistent framework that got the best of local flavor and central models. This, along with extensive use of data and models to evaluate performance and prioritize or de-prioritize collections, has been widely recognized as the best-in-class use of analytics in collections.”

Vivek Narayanan Nair, AGM – BIU at ICICI Bank adds, “This project has enabled rapid deployment of cutting edge statistical models that have not only enhanced process efficiencies but also customer experience.”