Maxim_Kazmin - Fotolia

The diagram that scares the next generation of banking IT professionals

The next generation of IT professionals in the banking sector will face the same legacy headache as their predecessors

The banking industry is at a turning point and the next generation of IT leaders in the sector are likely to be the ones to take on the legacy systems, but the challenge is not getting easier.

RBS is once again in the news after an IT failure prevented payments reaching people’s accounts when they should have. RBS said it has identified what the problem was, but would not tell Computer Weekly when asked.

The fact that 600,000 payments, including tax credits and disability living allowance, did not arrive when expected has huge ramifications for many customers.

The bank said all accounts will be updated by Saturday 20 June.

This follows a ₤56m fine by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) in relation to a massive IT outage in 2012. In the summer of that year, the CA-7 batch process scheduler froze 12 million accounts. Customers were unable to access funds for a week or more as RBS, NatWest and Ulster Bank manually updated account balances.

The regulator demonstrated that it is prepared to impose heavy fines for IT-related problems that affect customers. But the fines are only part of it. With banks facing competition from new challengers in the finance sector, customers can now vote with their feet.

So banks need to address the legacy IT systems that are often blamed for outages. However, the next generation of banking IT professionals, with dreams of ripping out legacy systems and replacing it with the latest and greatest technologies used by the likes of Google and Amazon, are in for a shock.

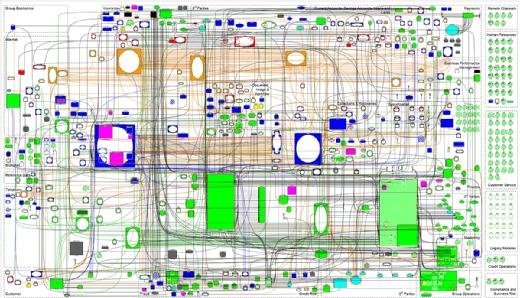

Here is a picture that will prepare them for the challenge.

IT complexity in a single mortgage system at a bank

This diagram was picked up at an event recently. It depicts all the individual processing components and their interdependencies in a single mortgage system at a large, full-service retail bank.

Big banks have thousands of systems providing current accounts, savings accounts, mortgages, loans and many more. All of these will have a diagram similar to this associated with them. Some systems at banks are now only understood by a couple of people, and newcomers to IT are not prepared.

One IT professional in the banking sector said schematic diagrams such as these are the “bread and butter of describing any system”, likening them to a “wiring diagram of a car showing all the components and wiring between them”. These diagrams are created during design and maintained over the years as part of the operational documentation, he added.

He said the boxes are typically applications, functions, databases and services, with the wires representing interfaces (read/write of data). “In addition to this would be a hardware view showing what mainframes, servers, network kit and locations are being used,” he said.

“An application usually has an inventory showing upstream and downstream dependencies for each component part, and there can be thousands of parts in a system and thousands of systems in a global bank. That's why IT people in banks should get paid well. It's fiendishly complex and has a huge impact if something goes wrong. Rocket science is probably easier,” he added.

Read more about IT in banking

- A banking T-Rex is dying and nimble competitors will pick at its carcass. Is it too late for the retail bank giants to overhaul their IT and survive?

- The Royal Bank of Scotland (RBS) has failed to invest properly in its IT systems over the years, leading to a number of high-profile IT failures that have prevented customers from accessing their own money.

- Computer Weekly looks at six challenger banks and their use of IT to differentiate.

- There is a rising clamour across the world for the big banks to be broken up – and the technology industry is key to providing an alternative.

But banks must take on this challenge or face threats from more agile competitors targeting specific financial services. So what can they do?

Here are some potential options outlined by a senior banking IT executive:

- Forget changing systems and try to remove complexity. This is what often happens when the people making the decisions are near retirement or can’t stomach a multi-year, multibillion-pound project.

- Buy a modern core banking platform off the shelf, get it working, connect it and migrate everything from legacy systems onto it.

- Acquire one of the growing number of new banks with their state-of-the-art IT, and eventually move the whole bank onto these modern systems, which can be tailored to the bank’s needs.

- Spend money on a state-of-the-art system and make it pay through acquiring other banks and moving them to the platform.

- artificial intelligence (AI) could solve complexity issues. For example IPSoft’s AI customer service platform, known as Amelia, can read all instruction manuals and automated fixes and could possibly support legacy transformation.

Jean Louis Bravard, IT outsourcing consultant and former JP Morgan CIO, said: “Nobody has the balls to replace legacy systems at the big banks.” Although RBS has worked out the problem, he said recovering from it will involve painstaking manual work to ensure no mistakes.

Legacy systems can be replaced, but big banks are not taking it on because they are led by people who don’t understand technology. “The root cause of this is that banks are being managed by former traders,” said Bravard. “Under this leadership, no big bank is going to invest huge sums of money over five years with no return on it.”